By Kotaro Fuji and Marie Tanaka (Nishimura & Asahi)

1. Introduction

A new law, called the “Early-Stage Business Restructuring Act” (“New Act”), which introduces a new out-of-court workout structure (“New Regime”) in Japan, was passed by Japan’s Congress on June 6, 2025 and is expected to come into effect by December 2026. The New Act enables a debtor company (“Debtor”) to perform an out-of-court restructuring by 75% majority vote (but only by a single class, so it will constitute an in-class cramdown) instead of unanimous consent of the creditors.

2. Background of the New Act

2.1. Positive features of existing out-of-court workouts

Japan has several existing out-of-court workout structures, such as the Guidelines for Business Turnarounds of SMEs (“SME Turnaround Guidelines”) and turnaround alternative dispute resolution (“ADR”), which are formal, rules-based out-of-court workouts, but by nature are still purely consensual, negotiation-based workouts. Generally speaking, out-of-court workouts are conducted without being publicly disclosed, while the fact that a Debtor commences court-supervised restructuring proceedings is public information. In addition, trade creditors generally are not involved in out-of-court workouts, unlike court-supervised restructuring proceedings, in which the norm is to involve and impair all creditors, including trade creditors. Therefore, it often is said that out-of-court workouts may have a less detrimental impact on a Debtor’s business than court supervised restructuring proceedings.

2.2. Issues with existing out-of-court workouts

However, the existing out-of-court workout procedures require the consent of all participating financial creditors to achieve an out-of-court restructuring. Because of this unanimous consent requirement, some Debtors have faced difficulties conducting out-of-court restructuring procedures successfully within a desirable timeframe. For example, there are cases in which only one (or a very few) financial institutions opposed an out-of-court workout even though the workout was thought to be financially and commercially reasonable. In addition, when there is a foreign lender among the financial creditors involved in an out-of-court workout, and that foreign lender is not familiar with Japanese out-of-court workouts, it may be difficult to obtain consent within the expected timeframe. In these circumstances, even where an out-of-court workout is financially/commercially reasonable, it could be unsuccessful, and a Debtor may need to file for court-supervised restructuring, such as civil rehabilitation, corporate reorganization, or bankruptcy.

2.3. Expected increase in the number of Debtors seeking business restructuring

As most of the emergency aid provided by governments and institutions during the Covid-19 pandemic is ending, it is expected that an increasing number of Debtors that have excessive debts may require business restructuring or face bankruptcy. However, as discussed in section (1), Debtors prefers out-of-court workouts and tend to avoid court-supervised restructuring proceedings, even when facing financial difficulties; this sometimes prevents necessary restructuring from taking place in a timely manner. To deal with this expected increase in restructuring cases, Japanese lawmakers believed it was essential to introduce a new, speedy and smooth out-of-court workout structure that does not require unanimous creditor consent.

2.4. Concerns about out-of-court workouts with majority consent

It also has been argued that a process that allows discharge of only financial claims by majority vote (i.e., without consent from all of the relevant financial institutions) might violate Japan’s Constitution. Another issue involves how to ensure fairness among the creditors involved in the proceedings. The New Act takes certain steps to address these issues as described below, and provides an option through which corporate Debtors can engage in out-of-court workouts.

3. Outline of the New Regime

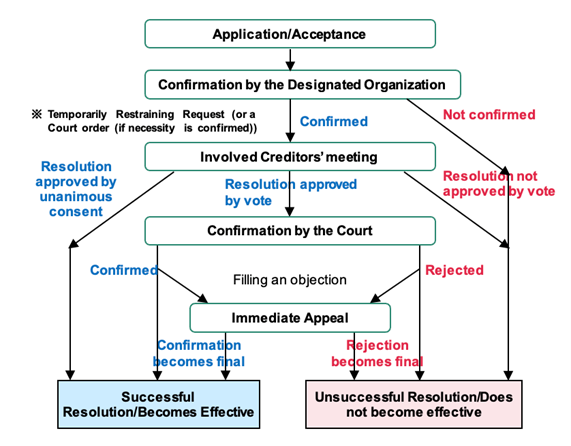

A summary of the New Regime, excerpted from materials created and published by the Ministry of Economy, Trade and Industry, is as follows.

Based on the language of the New Act and other materials published by the government, the New Regime appears to have the following features:

3.1. Limited Claims/Creditors Involved

One of the features of the New Regime is that only financial claims (i.e., loan claims and other claims based on provision of credit) belonging to financial institutions (“Involved Creditors”) can be involved in, or impaired or bound by, the New Regime. In order to facilitate timely restructuring, trade creditors are not involved in the New Regime. In addition, the claims that are subject to modifications of rights (e.g., debt haircuts, rescheduling) (“Involved Claims”) are limited to unsecured claims held by Involved Creditors. Secured claims (i.e., claims covered by security rights) held by Involved Creditors are not subject to modification under a Debtor’s Plan (as defined below).

Details about the scope of Involved Claims and Involved Creditors will be designated in an ordinance to be issued by the Ministry of Economy, Trade and Industry; however, that ordinance had not been published as of the date of this article. As such, some aspects of the process remain unclear, for example, whether a secondary purchaser of a bank loan that does not fall within any of the categories of financial institutions listed in the New Regime will qualify as “Involved Creditors.”

3.2. Threshold Requirement

A Debtor can use the New Regime if there is a risk that the Debtor may be unable to pay its debts that are due without hindering the continuation of its business. This requirement is lower than that for court supervised restructuring proceedings.

3.3. Application and confirmation by Designated Institution

A Debtor that intends to use this New Regime must apply to a third-party organization designated by the Ministry of Economy, Trade and Industry (“Designated Institution”) and provide a summary of its business restructuring plan (“Plan”). Designated Institutions that meet certain specific requirements will be designated by the Minister of Economy, Trade and Industry. The details of the designation process will be established in an ordinance to be issued by the Ministry of Economy, Trade and Industry, but that ordinance had not been published as of the date of this article.

The Designated Institution will confirm whether the Debtor meets the relevant requirements, for example, (i) there is a risk that the Debtor may be unable to pay claims that come due without causing hindrance to the continuation of its business, (ii) it is not obvious that the Plan is unlikely to be passed at an Involved Creditors’ meeting, and (iii) the Plan generally is expected to benefit the Involved Creditors (the “liquidation value principle,” which is a Japanese equivalent to the best interests test under Chapter 11). After the Designated Institution confirms the Debtor’s application, it will send a “request” for a voluntary standstill to all Involved Creditors, asking them to temporarily refrain from exercising Involved Creditor’s rights. If all of the Involved Creditors consent, the Debtor shall not pay the Involved Claims at that time.

3.4. Resolution at an Involved Creditors’ meeting

To approve a Plan that modifies creditors’ rights such as (i) reducing and releasing Involved Claims (i.e., debt haircut), or (ii) extending the repayment dates of the Involved Claims (i.e., reschedule), it is necessary to obtain consent from the holders of at least three-quarters of the total amount of the Involved Claims (which basically equate to voting rights in this context). However, if a single Involved Creditor holds more than three-quarters of the total Involved Claims, it also is necessary to obtain consent from a majority of the Involved Creditors who attend the Involved Creditors’ meeting (by head count). This requirement exists to protect minority Involved Creditors.

3.5. Confirmation of the Plan

After the Plan is approved at the Involved Creditors’ meeting (except where unanimous consent is obtained), the Debtor will file a motion with the appropriate court seeking confirmation of the Plan, without delay. After reviewing the Plan and a confirmation report prepared by the Designated Institution, the Court will confirm the Plan, except in situations in which the New Act states that the Court must reject the Plan; for example, where the proceedings have violated the law, or where the approval obtained goes against the general benefit of the Involved Creditors (which is interpreted as failing to satisfy the best interests test).

To ensure the fairness of the proceedings, the Debtor and the Involved Creditors can file an immediate appeal from a court decision to confirm or reject the Plan.

Although the New Regime involves courts and includes an in-class cramdown mechanism, it is not considered a formal in-court insolvency/restructuring proceeding. It lacks collectivity, because it involves only certain types of creditors (i.e., financial creditors) and does not offer tools typically available in court-supervised restructuring proceedings, such as avoidance actions or the ability to assume or reject executory contracts.

4. Future Outlook

As mentioned previously, several matters that must be designated in an ordinance issued by the Ministry of Economy, Trade and Industry have not yet been determined. However, even after those matters are established, Debtors facing difficulties may tend to choose existing out-of-court proceedings, which require unanimous consent, at least as long as the actual practices for implementation of the new procedure remain uncertain. That said, it also is expected that Debtors may put pressure on creditors to grant unanimous consent to a restructuring plan in existing out-of-court proceedings by leveraging the possibility of shifting to the New Regime. In addition, as a general practical matter, if unanimous consent is obtained, future business operations and the relationships with financial institutions (and even future financial arrangements or funding) may proceed more smoothly.

On the other hand, where a foreign lender is involved in the proceedings, and it may be difficult to obtain unanimous consent within the expected timeframe, this New Regime may offer a viable alternative to resolve the situation. In any case, it will be beneficial for an increasing number of Debtors to use the New Regime, so that precedents and experience can develop and the New Regime can become a useful, reliable procedure.

From the perspective of a potential sponsor, it is advisable to understand the features of the New Regime, and to assess why (or why not) a Debtor chooses this structure (specifically, the reasons why (or why not) the Debtor and its advisors expect the proceedings will be successful).