Game Theory in Action: Making the Deal Happen in Large and Complex Debt Restructurings (2/2)

By Ravindran Navaratnam (Sage 3)

Introduction

In the first part of the series, we shed light on the dynamics that exist between the borrowers and lenders in the context of debt restructuring. In the second series, we shall discuss the implications for lenders arising from their impairment policy. We demonstrate policies that banks could adopt in respect of impairment of loans which affects restructuring. Our argument lies on the fact that lenders should adopt realistic impairment policies, affecting the carrying value of non-performing loans (“NPLs”) and thus, we shall delve into and further discuss the three (3) impairment scenarios and their outcomes in this article.

Banks, i.e., the lenders, adhere to a set of stringent rules and regulations, guided by the Basel standards, governing various aspects of their operations. Among these regulations lies a critical guidance concerning the carrying value of loans. However, the accuracy of these valuations can be severely impacted by information asymmetry, posing significant challenges for banks in decision-making processes regarding restructuring versus liquidation. This ultimately results in sub-optimal decisions. The manner in which banks operate plays a pivotal role. In this respect, the determination of the carrying value of loans is not made by the recovery officers managing these NPLs, but by finance teams, who consider the lender's impairment policy. This policy then shapes the bank's perspective towards settlement offers, where offers exceeding the carrying value normally result in acceptance by the lenders, leading to a write-back of the loan. Conversely, offers below the carrying value are to be rejected. The challenge for banks is that they do not have a good understanding of the post-restructuring value or the liquidation value of the borrower's business, as this requires significant specialist valuation skills.

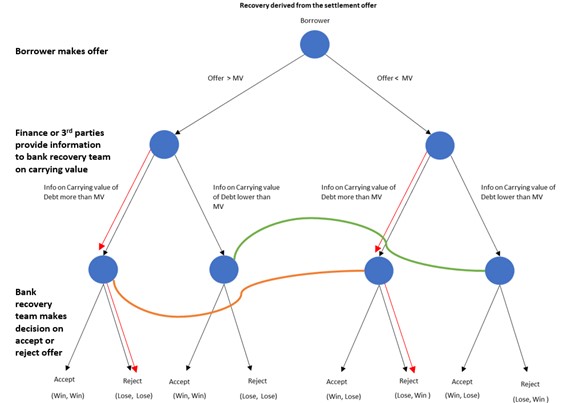

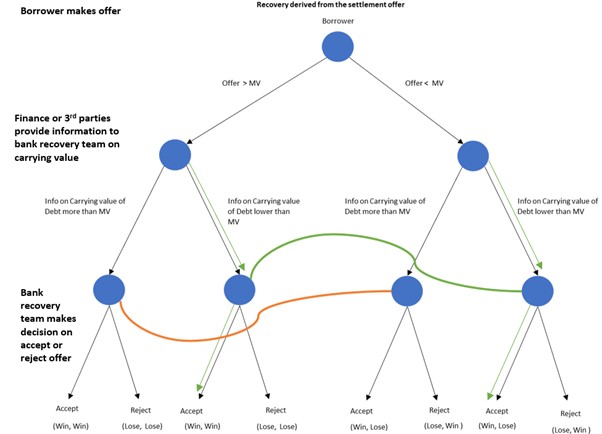

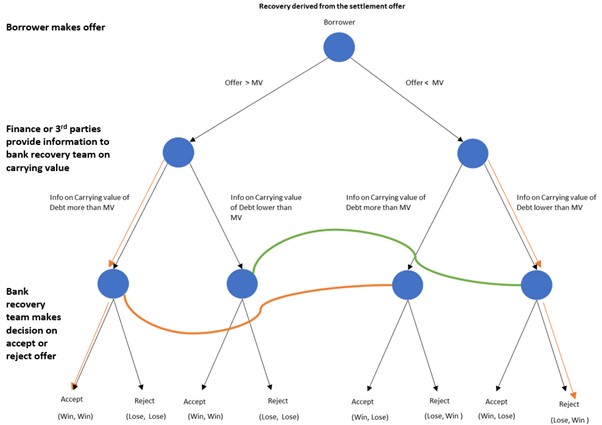

We apply a game theory that captures an overview of the decisions and outcomes relevant to the details of the impairment policy adopted by the lenders. Additionally, the policy game incorporates input from advisers regarding the reasonableness of settlement offers that may influence the carrying value of the loan. Crucially, the outcomes of these decisions are dependent on whether the offer surpasses or falls short of the market value, alongside the information availed to the lender. We delve into three (3) distinct scenarios to dissect the implications of different impairment policies on loan carrying values (refer to the diagrams below).

1. Low or Lax Impairment Policy

Figure SEQ Figure \* ARABIC 1: Low or Lax Impairment Policy by Lender

Under this scenario, where the impairment policy is very much lenient, the lenders would choose to reject settlement offers, missing out on the payoff of a genuine win-win outcome. Meanwhile, if the offer is below market value, the lenders are likely to reject the offer, making the correct decision.

External advisers to the lenders may potentially have disingenuous intentions to exploit the situation. They might assert a higher recovery value based on Market Value (“MV”), creating an inflated “expectation of carrying value”. A conflict situation could arise where they then secure a mandate to dispose assets. Personal guarantees can also have a similar impact on banks by creating an inflated “expectation of carrying value’’. This could lead to destruction of value by the promoters acceding to making unsustainable offers for settlement to lenders due to desperation.

2. Lower Carrying Value and Stringent Impairment Policy

Figure SEQ Figure \* ARABIC 2: Lower Carrying Value and Stringent Impairment Policy

Alternatively, an aggressive impairment policy may result in a lower carrying value for loans, potentially exposing lenders to lost opportunities by accepting sub-optimal settlement offers. Advisers to borrowers may further exacerbate this by advocating for reduced recoveries, at the expense of optimal recovery for the lenders if their remuneration is motivated by debt waivers.

3. Perfect Computation of Impairment and Correct Carrying Value of Loans

Figure 3: Optimal Carrying Value and Perfect Impairment Policy

Note: The scoring is based on a total payoff of 10 for a restructuring and 2 for winding up i.e., from the recovery officer’s perspective. Therefore, a win-win is scored 5+5, and lose-lose 1+1. In the restructuring, where win-lose situations arise, 2 points are given to the borrower (value under MV not allocated to borrower) and minus 2 for the lender. In the winding up, with a lose-win situation, the additional 1 point goes to the lender, derived from the value of teaching the borrower a lesson.

In the diagram, we have laid out the payoff for accepting or rejecting an offer, as well as the outcomes for players winning or losing in the scenario. This ideal scenario emerges when lenders accurately compute impairment values and are informed by precise information from advisers or risk management. Here, decision-making regarding loan restructuring or managed disposal is optimized, underscoring the importance of maintaining accurate carrying values.

Discussion

Whist an ideal situation is desired in the real world, this is unrealistic. Thus, the real choice is between a lax and stringent impairment policy. Therefore, we simulate a game with the payoff as follows:

We set out the probability of 50:50 between borrower’s genuine and opportunistic offers. The ensuing result for the Payoff under lax conditions, Plax, is compared against the Payoff under stringent conditions, Pprudent.

|

Lax impairment policy |

Stringent impairment policy |

|

Plax = 1/2X 1 + 1/2X 2 = 1.5 |

Pprudent = 1/2 X 5 + 1/2X 3 = 4 |

In this model, there is a clear benefit for banks adopting a stringent policy. However, in reality, an experienced officer could accurately estimate the genuineness of borrowers and therefore, influence the settlement offers being received to be more genuine and optimised. Thus, we now set the probability at 80:20 between genuine borrower offers and opportunistic offers. This results in the following outcome:

|

Lax impairment policy |

Stringent impairment policy |

|

Plax = 4/5X1+ 1/5X 2 = 1.2 |

Pprudent = 4/5X5 +1/5X 3 = 4.6 |

Progressive lenders fully appreciate and understand the value of exceptional recovery officers able to make the correct judgment on the borrower and enter into settlement agreements that are realistic and motivate the borrowers to work for themselves and the lenders. This was indeed the hallmark of Danaharta’s success during the Asian Financial Crisis.

Conclusion

The most effective way to move forward for a more effective and efficient restructuring is by having banking regulators direct lenders to adopt strict impairment measures. This approach results in higher payoffs for lenders compared to a more lenient policy which also helps genuine borrowers. The drawback of a strict policy, where lenders may be taken advantage of, is minimized by the community of bank restructuring officers and advisers who have a deep understanding of restructuring and adhere to institutional norms wherein there is trust between lenders and advisers. Accordingly, professional education on restructuring inclusive of lenders and advisors should be advanced. This ultimately leads to positive outcomes for the economy by facilitating business renewal and preserving the intangible value that would be lost in the case of liquidation.

(*) Acknowledgment: I would like to express my sincere thanks to Professor Lim, WooYoung of HKUST for providing guidance and exceptional teaching on game theory. I would also like to thank my staff at Sage 3, Durra Qistina Shaiful Bahari and Amir Syamil Amrin, for their support in helping me write the paper and for their keen interest in game theory.